All posts by Joann Samelko, REALTOR®

Happy New Year and Best Wishes for 2017

The top 20 home design trends of 2017

Wanted to share this article from Inman News _

What sellers and stagers should know about the trends ahead.

- 2017’s home design trends are all about creating lush spaces by taking traditional designs and making them modern with unique color, texture and material choices.

- As far as color, experts suggest grays with warm beige undertones for living rooms and kitchens, and bold reds and rich caramels for bedrooms.

- When it comes to remodeling, homeowners are favoring upgrades that make day-to-day life more convenient and luxurious.

Take note: The next year’s home trends call for lush colors, plush textures and modernistic takes on traditional designs that make the perfect environment to create a “new you.” (Or for staging a buyer’s new home!)

Although it may not be advisable to incorporate all these trends into a home you’re trying to sell, HomeAdvisor Chief Economist Brad Hunter says Realtors can use the following trends to help buyers imagine how a potential new home could look.

“Ideas for changing color schemes, updating countertops and undertaking more significant remodels can be mentioned while showing the home, depending upon the body language and comments the shopper is making,” said Hunter.

Furthermore, he noted that 2017’s trending renovations, such as “human docking stations” and “shedquarters” — along with upgrades, such as new appliances, countertops and cabinets — can help a home get sold quickly and at a higher price. Score!

Traditional kitchens with a twist

1. Built-in bars

Bring the party home with a sleek built-in bar.

The trend, which is a twist on 2016’s bar cart trend, is the perfect addition for homeowners who love to entertain. The bars add instant pizzazz to an otherwise traditional kitchen, plus offer built-in shelving for cocktail fixings, drinks, glasses and everything you’ll need for a ritzy night in.

2. Contrasting islands

Is a built-in bar a little over-the-top for you? Then a colorful island is a simple substitute that offers extra room for mixing drinks and whipping up tasty snacks for family and friends.

The key to nailing this trend and making it modern is choosing a contrasting color. Have a kitchen with a lot of warm hues? Choose an island in a cool shade, as seen in the photo below.

3. Colored island plus colored fridge

Feeling colorful? Add a 1950s-style fridge in a vibrant hue to your kitchen.

4. Hexagonal tile backsplash

It might have been “hip to be square” in 2016, but 2017’s tile designs are all about experimenting with other geometric shapes — namely, hexagons. Go for a cool, monochromatic look as seen below, or choose a few complementary colors for a punchy focal point.

5. White and wood kitchens

If complex geometric shapes and bright colors aren’t your cup of tea, embrace a simple style with white accessories and wood countertops for a modern twist on country chic.

Photographee.eu / Shutterstock.com

6. Wall of tile in kitchen

See a pattern here? Clearly, 2017’s kitchen style heavily relies on tile to create focal points and direct the overall vibe of a kitchen.

Homeowners who think a backsplash isn’t enough are covering their kitchens with full floor-to-ceiling and wall-to-wall tiles.

7. Marble surfaces

Is tile simply not for you? If so, opt for marble in shades of white and light gray for countertops, flooring, tabletops and home accessories, such as serving platters and vases.

In living color

8. Go Greenery

Recently, Pantone released its 2017 color of the year, Greenery.

Greenery is bright, lush and perfect for homeowners who want to bring the outdoors indoors. But Real Estate Staging Association CEO Shell Brodnax says sellers would be wiser to stick with neutral colors, such as grays with beige undertones.

9. Opt for Shadow or Poised Taupe

Brodnax favors Benjamin Moore’s color of the year, Shadow 2117-30, and Sherwin Williams’ color, Poised Taupe SW 6039, both of which are neutral tones that add understated warmth to a room.

10. Beige is in

If gray is a little too dim, consider using a palette of beige-based neutrals to create a warm and cozy atmosphere.

11. Don’t forget the color!

With all these neutral tones taking stage in 2017, it’s important to add pops of color to keep your space from looking “blah.”

Designers and homeowners alike are favoring saturated jewel tones (such as emerald green and sapphire blue) in artwork, furniture and other home accessories.

12. Velvet aboveground

Another way to add color and texture to a space is with a velvet statement piece. Designers are adding the lush fabric on sofas, throw pillows and even curtains for a sultry look.

In the bath

13. You’re so vain

Vanities are making a comeback, and instead of reaching for pre-manufactured designs, homeowners are getting crafty by using chests of drawers, old file cabinets and vintage consoles to make one-of-a-kind pieces.

Photo by Louise de Miranda – More industrial bathroom ideas

14. Black steel (and glass)

Take your shower to the next level with black steel and glass doors. The result is an understated chic space that allows plenty of natural light to come through.

Playful bedrooms

15. They hang brightly

Instead of table lamps, consider hanging pendant lights in the bedroom to create a whimsical style. This option works especially well in small rooms where there’s no space for nightstands (or where you want to use your nightstand space for something besides a lamp).

16. Time for romance

While neutral tones will be popular for living rooms, kitchens and bathrooms, warm, romantic colors will rule bedrooms.

According to Houzz, colors like raspberry pink, deep ruby red, caramel and even black are the perfect shades to make a room that Cupid will want to stay in all year long.

Let me upgrade you

HomeAdvisor Chief Economist Brad Hunter says 2017 will be about lifestyle renovation projects that make day-to-day life convenient and more luxurious.

“The kinds of projects that were deferred during the recession, and for several years after the recession ended [will be popular],” says Hunter.

“People decided back then to be very judicious with their money, and so they put off some of the enhancements.”

18. Human docking stations

Hunter says that since Wi-Fi allows homeowners to work anyplace within the home, there’s less of a need for a home office.

He notes there does have to be a place to store printers, file cabinets and so on, but in 2017 homeowners will opt for “docking stations” made out of a small equipment cabinet with a drop-down or pull-out desk surface to tackle quick tasks.

19. Garage remodels

Garages are notoriously misused as storage spaces, some with barely enough room for a car.

Hunter says garages can be put to use by converting them into mother-in-law suites or as a guest room for family and friends.

20. Shedquarters

“The term ‘shedquarters’ has been used to refer to a small structure that is on the property, but outside the house, often utilized for home-based businesses,” says Hunter.

“This is a spinoff of the ‘tiny house’ movement, and one that will see more interest in the next couple of years. We expect to see more of these planned for ‘flex’ or ‘hybrid’ use, such as [an] office/party room.”

All listed trends were sourced from Zillow, Houzz, HomeAdvisor and RESA.

JOANN’S ONLINE HOLIDAY MAGAZINE

COVER

IN THIS issue

From Empty Nest to Full House… Multigenerational Families Are Back!

Multigenerational homes are coming back in a big way! In the 1950s, about 21%, or 32.2 million Americans shared a roof with their grown children or parents. According to a recent Pew Research Center report, the number of multigenerational homes dropped to as low as 12% in 1980 but has shot back up to 19%, roughly 60.6 million people, as recently as 2014.

Multigenerational households typically occur when adult children (over the age of 25) either choose to, or need to, remain living in their parent’s home, and then have children of their own. These households also occur when grandparents join their adult children and grandchildren in their home.

According to the National Association of Realtors’ (NAR) 2016 Profile of Home Buyers and Sellers, 11% of home buyers purchased multigenerational homes last year. The top 3 reasons for purchasing this type of home were:

- To take care of aging parents (19%)

- Cost savings (18%, up from 15% last year)

- Children over the age of 18 moving back home (14%, up from 11% last year)

Donna Butts, Executive Director of Generations United, points out that,

“As the face of America is changing, so are family structures. It shouldn’t be a taboo or looked down upon if grown children are living with their families or older adults are living with their grown children.”

For a long time, nuclear families, (a couple and their dependent children), became the accepted norm, but John Graham, co-author of “Together Again: A Creative Guide to Successful Multigenerational Living,”says, “We’re getting back to the way human beings have always lived in – extended families.”

This shift can be attributed to several social changes over the decades. Growing racial and ethnic diversity in the U.S. population helps explain some of the rise in multigenerational living. The Asian and Hispanic populations are more likely to live in multigenerational family households and these two groups are growing rapidly.

Additionally, women are a bit more likely to live in multigenerational conditions than are their male counterparts (20% vs. 18%, respectively). Last but not least, basic economics.

Carmen Multhauf, co-author of the book “Generational Housing: Myth or Mastery for Real Estate,” brings to light the fact that rents and home prices have been skyrocketing in recent years. She says that, “The younger generations have not been able to save,” and often struggle to get good-paying jobs.

Buying A Home

Buying a Home Can Be Scary… Know the Facts [INFOGRAPHIC]

![Buying a Home Can Be Scary... Know the Facts [INFOGRAPHIC] | MyKCM](http://s3.amazonaws.com/kcmmedia/2016/10/24133924/20161028-ENG-STM-1046x667.jpg)

Some Highlights:

- 36% of Americans think they need a 20% down payment to buy a home.

- 44% of Millennials who purchased a home this year have put down less than 10%.

- 71.8% of loan applications were approved last month.

- The average credit score of approved loans was 731 in September.

Mortgage Process

Taking the Fear out of the Mortgage Process

A considerable number of potential buyers shy away from jumping into the real estate market due to their uncertainty about the buying process. A specific cause for concern tends to be mortgage qualification.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need to have saved for a down payment (the average down payment on all loans was 11% last month, with many buyers putting down 3% or less), a stable income and good credit history.

Throughout the entire home buying process, you will interact with many different professionals, all of which perform necessary roles. These professionals are also valuable resources for you.

Once you’re ready to apply, here are 5 easy steps that Freddie Mac suggests to follow:

- Find out your current credit history & score – even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score of all closed loans in September was 731, according to Ellie Mae.

- Start gathering all of your documentation – income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional – your real estate agent will be able to recommend a loan officer that can help you develop a spending plan, as well as determine how much home you can afford.

- Consult with your lender – he or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval – a pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change), and demonstrates to home sellers that you are serious about buying!

Down Payment Found

| Down Payment: FOUND! | |

| Saving the down payment may be unnecessarily keeping would-be buyers from getting into a home. They may be unaware that the funds might be available.

The NAR Profile of Home Buyers and Sellers reports that 81% of first-time buyers got all or part of their down payment from savings. Less than 4% said that all or part of the down payment came from a withdrawal in their IRA and 8% from their 401(k) or pension fund. Traditional IRAs have a provision for first-time buyerswhich include anyone who hasn’t owned a home in the previous two years. A person and their spouse, if married, can each withdraw up to $10,000 from their traditional IRA for a first-time home purchase without incurring the 10% early-withdrawal penalty. However, they will have to recognize the withdrawal as income in that tax year. For more information, go to IRS.gov. Allowable withdrawals from traditional IRAs can be from yourself and your spouse; your or your spouse’s child; your or your spouse’s grandchild or your or your spouse’s parent or ancestor. Roth IRA owners can withdraw their contributions tax-free and penalty-free at any age for any reason because the contributions were made with post-tax income. After age 59 ½, earnings may be withdrawn as long as the Roth IRA have been in existence for at least five years. Up to half of the balance of a 401(k) or $50,000, whichever is less, can be borrowed by the owner at any age for any reason without tax or penalty assuming the employer permits it. There can be specific rules for loans from a 401(k) that would determine the repayment; interest is usually charged but goes back into the owner’s account. You can consult with your HR department to find out the specifics. A risk in borrowing against a 401(k) comes if your employment ends before the loan has been repaid. The loan may have to be repaid as soon as 60 days to keep the loan from being considered a withdrawal and subject to tax and penalty. Even if you continue with the same employer, failure to repay the loan could be considered a withdrawal also. Your tax professional can provide you specific information on how making a withdrawal from your retirement program might affect you. Additional information can be found on www.IRS.gov. |

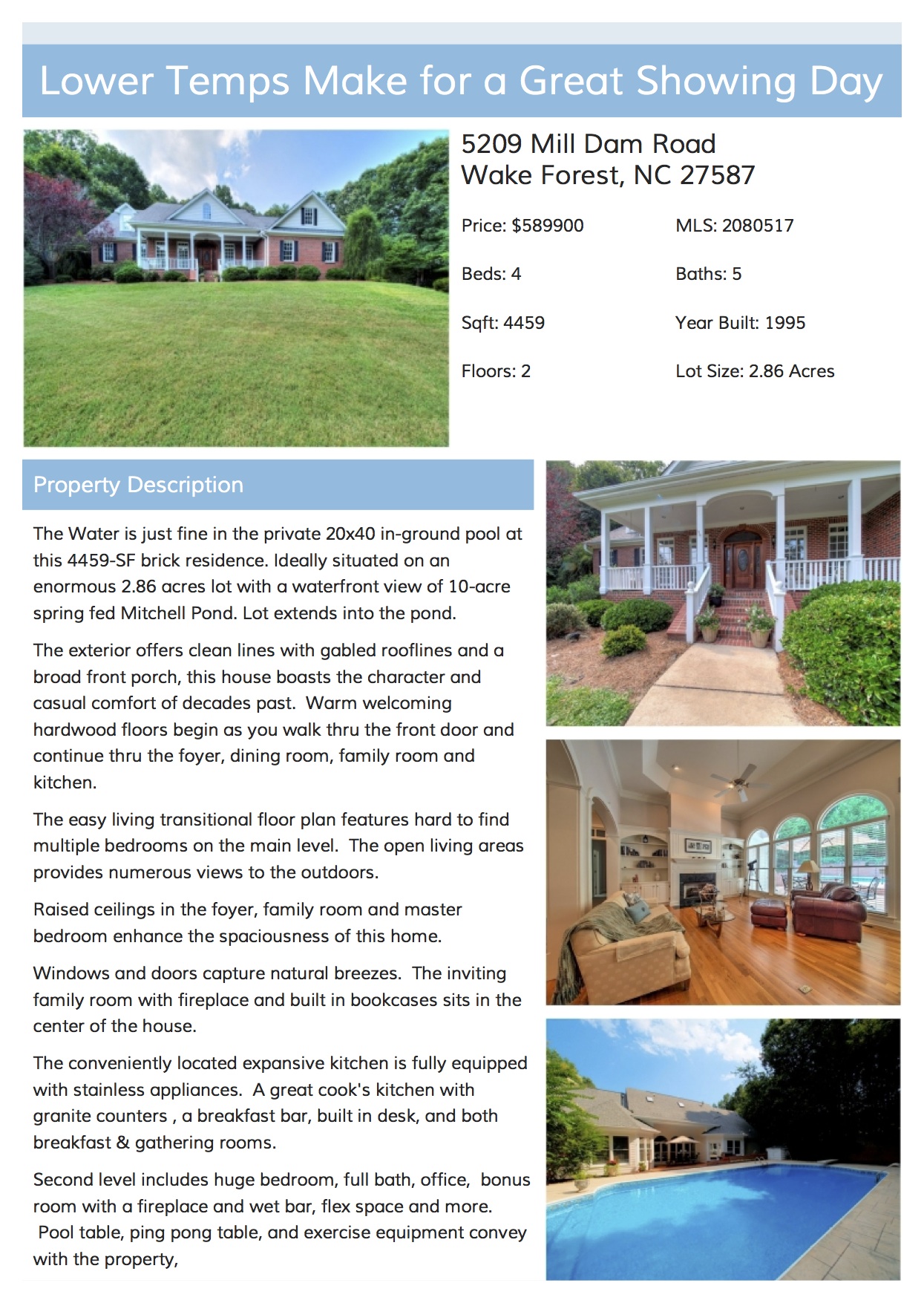

Lower Temps _ A Great Day to See this Wake Forest Gem!

Please Visit the Property Website for More Details: 5209 Mill Dam, Wake Forest NC