Made by Sellers When Choosing A Price For Their Home

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer.

Being intentional and competitive are musts when buying a home right now. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. According to the National Association of Realtors (NAR), homes are receiving an average of 5.1 offers for sellers to consider. As a result, bidding wars are more and more common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

Freddie Mac explains:

By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, and you’ve been pre-approved for a mortgage by your lender for a specific dollar amount. In a true bidding war, your offer will likely get dropped if you don’t already have one.

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals such as a loan officer and a trusted real estate agent making sure you take the right steps and can show your qualifications as a buyer when you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. Not only does being pre-approved bring clarity to your homebuying budget, but it shows sellers how serious you are about purchasing a home.

Selling your home can be surprisingly time-consuming and emotionally challenging. Strangers come in, poke around, critique your home, and then offer less than you think it’s worth – if anything at all.

Below are five tips for getting the highest possible price for your home within a reasonable timeframe:

1. Kick emotions to the curb

When selling your home, it’s best to see yourself as a businessperson rather than as a homeowner. Looking at the transaction from a purely financial perspective helps detach from the emotional aspects of selling your home.

2. Hire the best agent

A great agent will help set the right price for your home, strategically market your home and also play middleman, negotiator and problem solver. In addition, he/she will handle the enormous amounts of paperwork and pitfalls involved in real estate transactions – ensuring a smooth, stress-free experience for you.

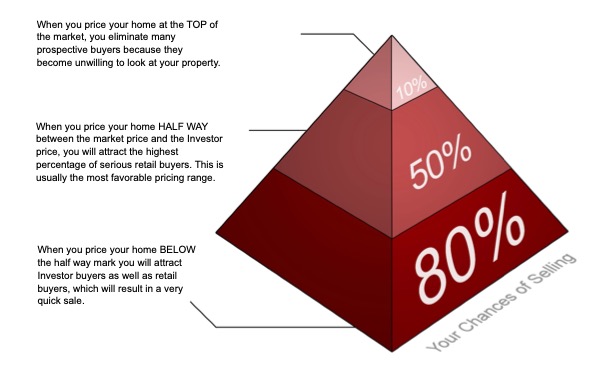

3. Price it right

But be open to negotiation. Smart buyers will negotiate and, if you want to complete the sale, you may have to play this game. It’s a good idea to list your home at a price that attracts buyers, while still leaving room for negotiation.

4. Make photos a priority

More than 85% of buyers start their home search online these days. Having multiple, crisp, clear photos – preferably taken by a professional – that showcase the entire house both inside and out will set your listing above the rest and help generate interest. An expert agent will be on top of this and ensure you have the right photos to highlight your home.

5. Primp and stage

If you don’t clean, stage and declutter your home, you’re leaving money on the table. Have a friend or allow your expert agent with a fresh pair of eyes point out areas that need work in case you’re too familiar to “see” the trouble spots. Decluttering, adding a fresh coat of paint, eliminating odors and pumping up the curb appeal make a great first impression.

Few sales – if any – follow the perfect script. However, taking note of these five tips will go a long way toward helping you achieve the seamless, lucrative transaction every home seller hopes for.

Rental homes whether they be single-family detached properties, condos, two, three or four-unit properties share many of the same benefits. Most people instinctively understand many of the working parts because they are the same as their home. They have a basic understanding of value and how to maintain the property. The service providers for a home would be the same for a rental home.

These properties allow an investor to obtain a large loan-to-value mortgage at fixed interest rates for up to thirty years. They appreciate in value, currently exceeding many other assets; have defined tax advantages and allow an investor more control than many alternative investments.

Most lenders require 20-25% down payment and will finance the balance at rates close to owner-occupied homes. Buyer closing costs will add another three to four percent to the amount of cash needed to close. It is also prudent to have available funds for repairs and maintenance.

There are successful real estate investors in every price range and part of town. If your ultimate goal is to have the rent handle the holding costs and to sell the appreciated property at the end of a seven to ten year holding period, it might be advantageous to stay in predominantly owner-occupied neighborhood. They usually appreciate faster and will appeal to a buyer who wants it for their home. Chances are, this type of buyer will pay a higher price than an investor who may not be willing to pay as high a price.

By staying in an average price range, or possibly, slightly lower, you’ll be able to appeal to the broadest group of not only buyers but also tenants while you are renting the property. Even during the mid-80’s when FHA interest rate was 18.5%, buyers were still purchasing homes. Whereas the higher priced homes have a tendency to slow down during trying economic times.

Ask your real estate professional what price ranges sell the best, rent the best and have mortgage money available.

Some investors manage their properties themselves and others don’t want to be involved. Professional property management has advantages like expertise, established contacts, operating statements and economies of scale. The main disadvantage is the cost factor but if they can rent it for a higher price and keep expenses lower than you can, it could minimize the difference.

A possible consideration might be to have a real estate professional place the tenant, check the credit and write the lease. There would be a one-time fee for this, but the owner/investor could then, manage the property, saving the expense of a monthly fee.

Understanding the landlord tenant laws would be particularly important to an investor managing their own property but regardless, the investor needs to have a basic familiarity of the law. There can be civil as well as criminal aspects. Examples might be that a landlord is required to change the locks on a property for a new tenant; the number of days before a landlord must return a deposit and what to do if there are damages causing all or part of it to be withheld.

Another tool that can be very helpful for investors is an investment analysis that will assist them in selecting a property that is likely to provide a satisfactory rate of return. Ask your real estate professional if they can provide this for you. They should be more familiar with rents and expenses to be able to determine the cash flow and what kind of yield you may be able to expect over your intended holding period.

For more detailed information, download our Rental Income Properties and contact me to schedule a meeting to talk about the possibilities.

Desirable location on quiet cul-de-sac street. Relaxing floor plan provides 4 bedrooms, 2.5 baths and 2833 square feet. This custom built property has a built brick front exterior with fiber cement siding. Listed Price: $ 499,000.

The house has tons of natural light and awesome details abound including dazzling hardwoods on main level, transoms, arches, heavy molding, plantation shutters, french doors and more.

The sunny kitchen features granite counters, island, gas cooktop, stainless steel appliances, built-in desk and breakfast area. Window over the sink with a view of the rear deck.

A charming sunroom is adjacent to family room, kitchen and deck. It is one of the favorite rooms in the home and a great spot to enjoy a book.

Spacious owner en-suite offers large walk-in closet, dual sink vanity, whirlpool, water closet, and walk-in shower. Secondary bedrooms are good size. 4th bedroom currently being used as a bonus room has a large closet.

This is a great house for entertaining. Freshly painted interior. No HOA and No dues.

View the Matterport Tour:

https://my.matterport.com/show/?m=2se2shaiCkc&brand=0

Contact Joann to view this property 919-616-2555.

The new normal of staying at home has many homeowners rethinking the way they live in their home and what they need in a home.

A home has always been a place to call your own, a place to raise your family, a place to share with your friends and a place to feel safe and secure.

An office at home for working is more important than ever, possibly a gym to stay in shape, a bonus space for media and recreation and room to spread out for individual quiet time.

8112 Greys Landing Way in Raleigh NC Checks All the Boxes:

*A private first floor ensuite for visiting guests or inlaws is located away from the main living areas of the house.

*A first floor office/study adjacent to the family room.

*A butler and walk in panty that provides mega storage and allows you to limit grocery store trips.

*A huge master ensuite with sitting area and spa bath.

*A princess ensuite for your own special princess.

*A bonus room/ media room that can double as a bedroom or a home gym.

Call me for more information about this great home 919-616-2555.