Category Archives: Investing in Real Estate

From Empty Nest to Full House… Multigenerational Families Are Back!

Multigenerational homes are coming back in a big way! In the 1950s, about 21%, or 32.2 million Americans shared a roof with their grown children or parents. According to a recent Pew Research Center report, the number of multigenerational homes dropped to as low as 12% in 1980 but has shot back up to 19%, roughly 60.6 million people, as recently as 2014.

Multigenerational households typically occur when adult children (over the age of 25) either choose to, or need to, remain living in their parent’s home, and then have children of their own. These households also occur when grandparents join their adult children and grandchildren in their home.

According to the National Association of Realtors’ (NAR) 2016 Profile of Home Buyers and Sellers, 11% of home buyers purchased multigenerational homes last year. The top 3 reasons for purchasing this type of home were:

- To take care of aging parents (19%)

- Cost savings (18%, up from 15% last year)

- Children over the age of 18 moving back home (14%, up from 11% last year)

Donna Butts, Executive Director of Generations United, points out that,

“As the face of America is changing, so are family structures. It shouldn’t be a taboo or looked down upon if grown children are living with their families or older adults are living with their grown children.”

For a long time, nuclear families, (a couple and their dependent children), became the accepted norm, but John Graham, co-author of “Together Again: A Creative Guide to Successful Multigenerational Living,”says, “We’re getting back to the way human beings have always lived in – extended families.”

This shift can be attributed to several social changes over the decades. Growing racial and ethnic diversity in the U.S. population helps explain some of the rise in multigenerational living. The Asian and Hispanic populations are more likely to live in multigenerational family households and these two groups are growing rapidly.

Additionally, women are a bit more likely to live in multigenerational conditions than are their male counterparts (20% vs. 18%, respectively). Last but not least, basic economics.

Carmen Multhauf, co-author of the book “Generational Housing: Myth or Mastery for Real Estate,” brings to light the fact that rents and home prices have been skyrocketing in recent years. She says that, “The younger generations have not been able to save,” and often struggle to get good-paying jobs.

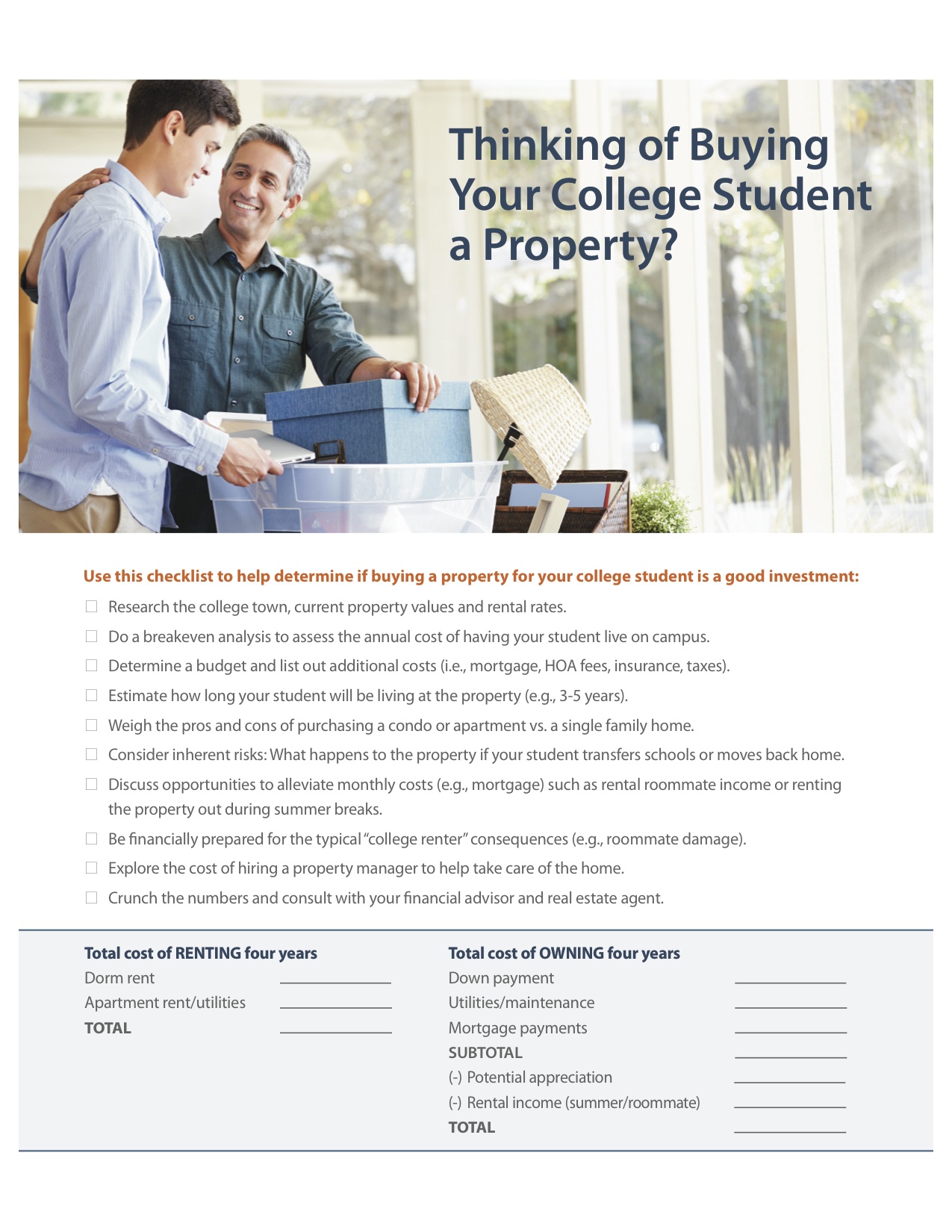

College Student Property Investment

Lunch and Learn Held on October 6th

I organized a Lunch and Learn at Northside Realty this week.

Eleven of my Northside colleagues joined me for lunch and an enjoyable presentation by David Stokes of Retirement Funding Solutions.

Agents gained valuable information about the ‘Home Equity Conversion Mortgage – HECM‘ A type of Federal Housing Administration (FHA) insured reverse mortgage for those age 62 or better.

The presentation included plenty of interaction and a good question and answer session followed. Everyone in attendance appreciated the additional knowledge and the fact that they learned about a program that could help their clients.

Today’s Featured Community: Bella Vista Raleigh

Bella Vista is a new luxury community ideally located just north of I-540.

Bella Vista is a new luxury community ideally located just north of I-540.

The community consists of seventy-seven acres in a prime North Raleigh location. Over 20 acres will be community open space.

There will be only 62 home sites that offer lakefront, meadow or basement opportunites. The homes will be situated on lots ranging from .67 acres to over 1 acre.

The utilities in the community will be natural gas, community water and private septic. County taxes only and HOA dues of $90 per month.

There are two parade homes to visit during the Parade of Homes Oct. 1-2, 7-9, and 14-16, 2016 from 12-5 p.m. Both of the parade homes already have sold signs on them.

The Builders At Bella Vista:

Ange Signature Homes

Bost Custom Homes

Don Collins Builder, Inc.

Legacy Custom Homes

Premiere Homes

Loyd Builders LLC

Rufty Homes

Shall Construction, LLC

Sundance Signature Homes

The Developer of Bella Vista is Henry MacNair.

I would be happy to show you this new luxury community and here is a link to Listings in Bella Vista.

The Easy and Fast Way to Find Homes for Sale

Instead of driving different neighborhoods, scouring countless Internet sites and talking to endless different agents, I can show you all the available homes for sale – my company’s listings, my listings, other broker’s listings, builders’ new homes, bank-owned homes and even for sale by owners.

- Click on the Search Homes button to see all of the homes without having to go to multiple websites. Search Homes

- Click on the Property Organizer button to save your search and have new listings sent to you by email daily.

- Contact me to do it all for you with the experience and expertise that only a real estate professional can offer.

Pay Off Your Mortgage?

Becoming debt free is as much a part of the American Dream as owning a home but there certainly can be conflicting circumstances that make the decision to pay off your mortgage early unclear.

The advantages of paying off debt early is increased cash flow, less interest paid and a higher credit score. The disadvantages are lower cash flow available as discretionary funds for meals, entertainment and other things. If the ultimate goal is financial security, is it worth the intermediate sacrifice?

Whether you pay off your mortgage early is a personal decision that may be right for one person and not for another. Consider the following before you get started:

Reasons you should

- Peace of mind knowing that you don’t have a mortgage

- You’ll save interest regardless of how low your mortgage rate is

- Lowering your housing costs before you retire

Reasons you shouldn’t

- You can invest at a higher rate than your mortgage

- You have other debt at a higher rate than your mortgage that needs to be paid off

- You might need the money in the future and want to remain liquid

- You might not qualify for a mortgage currently

- You should pay off other debt with higher interest rates

- Your employer has a matching retirement plan that would benefit you more

- You have more urgent financial needs like emergency fund, life, health and disability insurance

- You expect high inflation and the value of your mortgage debt will decrease

Use this Mortgage Accelerator to determine how quick you can pay off your mortgage.

5209 Mill Dam Rd, Wake Forest 27587

I am so excited about my newest listing in Millrace. This is a fabulous property situated on an almost 3-acre lot with a pond and in-ground pool. Virtual Tour

3 Reasons to Buy Luxury Property THIS Year!!

3 Reasons to Buy Luxury Property THIS Year!!

1. There are more homes from which to choose

According to a recent Wall Street Journal article, inventory in the upper end is increasing, while it is decreasing at the lower and mid-tier price ranges. Here is a graph showing the average increase/decrease in inventory for the first four months of this year as compared to last year:

2. Prices are becoming more reasonable

In a separate article, the Wall Street Journal also talked about prices in the luxury market. They explained that downward price adjustments have been more common in the luxury market than in markets with lower prices. They went on to say:

“The growing number of price cuts suggests luxury-home sellers are becoming more realistic about property values as sales have slowed, said several real-estate veterans.”

Not only will you have more to choose from, but you may also be able to get the property at a reduced price.

3. Mortgage rates are at historic lows

In the past, one of the drawbacks to purchasing a luxury property was the larger mortgage rate on “jumbo” loans which are often required on high end properties.

However, HSH.com just revealed that jumbo rates just set new record lows:

“While conforming fixed-rate mortgages eased a little this week, 30-year fixed-rate jumbos declined enough to break into new record low territory (3.66%), besting the previous low set in April by two basis points.”

Bottom Line

More choices, better prices and historically low mortgage rates may make this the perfect time for you to own one of those luxury properties you and your family have always fantasized about.

New Listing _ Close to NCSU

Perfect for Roommates or Investors!

2-Bedroom 2-Bath Amazing Investment Opportunity. Close to NC State, Farmers Market, Downtown, I-40 and I-440 access. Fully equipped with All Appliances included (microwave, refrigerator, stove, dishwasher, washer and dryer). New AC Air Handler, Updated Appliances, Carpet, Tiled Flooring, Paint, Bathroom Cabinetry, and Ceiling Fans. Eligible for FHA Financing _ On the FHA Approved Condo List. Seller is a Licensed Real Estate Professional.