| MAY HAPPENINGS WORTH A TRIP |

||

|

Apex PeakFest (5/6) brings all-day live music, arts and crafts, food and tons of family-friendly entertainment to downtown Apex. DETAILS

Downtown Raleigh’s Halifax Mall will host the Capital Cricket Classic (5/6), showcasing the sport of cricket with eight teams participating in seven knockout matches in a full day of fun with food and other festivities. DETAILS

Herbfest (5/6) features plant and craft booths, live butterfly releases, kids’ activities, food trucks, a bake sale and more in Cary. DETAILS

Out! Raleigh (5/6), a celebration of the LGBT community and its allies, will be an inclusive, family-friendly event in downtown Raleigh. More than 50,000 people are expected to take in the live music, local vendors and artists, a beer garden and the KidsZone. DETAILS

The Downtown Raleigh Food Truck Rodeo (5/7) returns with nearly a half-mile of food trucks lining Fayetteville St., serving everything from ice cream sundaes to buttery lobster rolls. DETAILS

Carolina Ballet closes out the 2016-2017 season with Carmen (5/18-21), the story of a woman who captures the hearts and souls of the men who love her. DETAILS

Artsplosure – The Raleigh Arts Festival (5/19-21) gathers nearly 200 artists and craftspeople to exhibit original works of art in 10 different categories across downtown Raleigh. Food trucks, art installations and tons of live music highlight a weekend of visual and performing arts. DETAILS

Animazement (5/26-28), celebrating popular Japanese visual culture, takes over the Raleigh Convention Center on Memorial Day weekend with cultural demos, guest panels, concerts and more. DETAILS

The admission-free, family-oriented WRAL Freedom Balloon Fest (5/26-29) returns to Fuquay-Varina. 30+ hot air balloons will take part in mass ascensions and “glows,” and lots of food and field games will be on hand. DETAILS

|

All posts by Joann Samelko, REALTOR®

Rent vs. Own

Would-be to Should-be

Some would-be buyers have emotional reasons to own a home like having a place of their own where they can raise a family, feel safe and secure and enjoy their friends’ company. Other buyers’ dominant reasons might be financial in nature such as building equity or lowering their cost of housing.

Regardless of what might be motivating people to want their own home, it is easy to justify that now is a good time to purchase. Let’s look at a $250,000 example using a FHA loan.

The total payment will be about $1,835 dollars a month. If the payment is lower than the rent a person is paying, that should encourage a person to continue investigating.

In this example, when you consider the monthly principal reduction, the monthly appreciation and the tax savings, even with money added for monthly maintenance, the net cost of housing is less than half the total house payment.

Considering all those advantages, the would-be buyer is spending over $1,100 per month more to rent than it would be to own. In a year’s time, they would lose close to $14,000 which is more than the down payment of $8,750 required on this price home.

Most would-be buyers understand that a home is a big investment but they may not understand the advantage of the leverage caused by the low down payment mortgage. The benefits extend beyond a return on the down payment but to the value of the home.

In this example, the $8,750 down payment grows to an equity of $73,546 in seven years based on 2% annual appreciation and normal amortization on a 30-year loan. If you calculated that as a rate of return, you’d be challenged to find anything that could compare with it.

To see what your numbers might look like, check out this Rent vs. Own. If you need any help or have any questions, contact us. Part of our greatest satisfaction is helping would-be buyers understand why they should-be.

Featured Neighborhood in North Raleigh

My Current Featured Neighborhood is the Inman Park Community.

My Current Featured Neighborhood is the Inman Park Community.

Inman Park is a planned community of 156 single-family custom homes, 96 townhomes in an area called The Enclave.

The Inman Park Community Association exists primarily to maintain a swimming pool and cabana, street lighting, architectural standards, and the landscape on common property. The Enclave Association performs the same duties for the townhomes. The two Associations maintain the swimming pool jointly.

Inman Park is a thriving community located in the Midtown area of Raleigh, near the Crabtree Valley Mall and North Hills shopping and entertainment district. Only a 5 minute drive to Rex Hospital and 20 minute commute from both downtown Raleigh and Research Triangle Park, Inman Park residents enjoy the convenience of close amenities without the hassle of a long commute. The subdivision was developed from 1990-2006 and consists of 252 units including single family dwellings and town homes. There is a community swimming pool and kiddie pool and an access trail to the Capital Area Greenway System.

To learn more about living in Raleigh in general or Inman Park specifically, contact me, Joann Samelko, today.

Please contact me when you’re ready to list your current property in this community. I’ll help you at every stage of the home selling process, starting with helping you determine the true value of your home.

View the Current Listings in Inman Park

Joann’s Online Magazine _ March 2017

First Comes Love… Then Comes Mortgage?

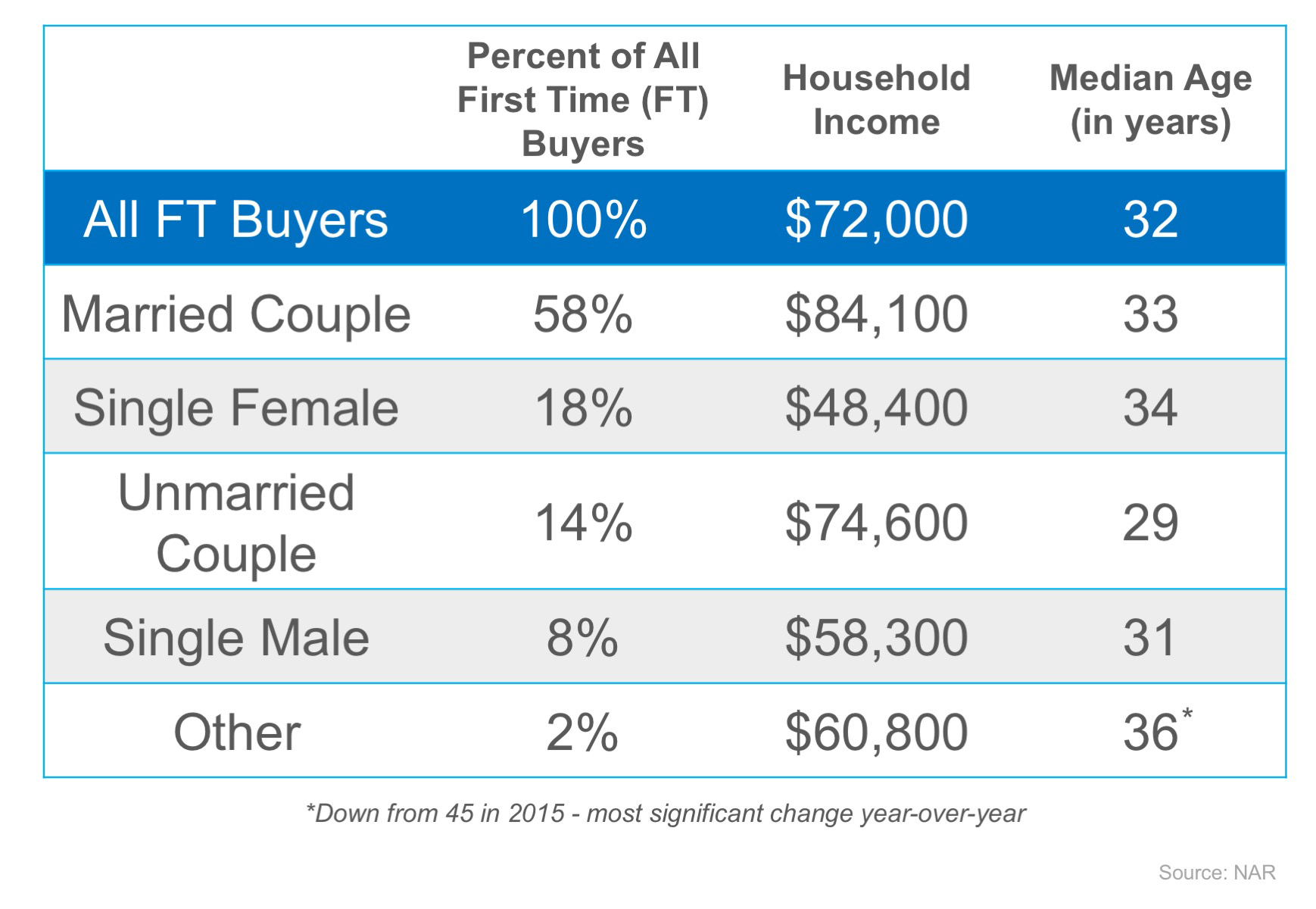

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers, married couples once again dominated the first-time homebuyer statistics in 2016 at 58% of all buyers. It is no surprise that having two incomes to save for down payments and contribute to monthly housing costs makes buying a home more attainable.

But, many couples are also deciding to buy a home before spending what would be a down payment on a wedding, as unmarried couples made up 14% of all first-time buyers last year.

If you’re single, don’t fret! Single women made up 18% of first-time buyers in 2016, while single men accounted for 8% of buyers. One recent article pointed to a sense of responsibility and commitment that drives many single women to want to own their home, rather than rent.

Here is the breakdown of all first-time homebuyers in 2016 by percentage of all buyers, income, and age:

Happy Valentine’s Day

Joann’s February Online Magazine

Proof of Purchase

Proof of Purchase

People who experience a property loss are usually asked by their insurance company for proof of purchase which can come in the form of a receipt or current inventory of their personal belongings.

Even the most organized people might find it challenging to find receipts for all the valuables in their home. If the inventory isn’t up-to-date, a homeowner might forget to add some items to the claim and may not recognize the omission for long after the claim is settled.

The inventory can serve as a guide to make sure a homeowner gets compensated for all the loss.

Photographs and videos can be adequate proof that the items belonged to the insured. A series of pictures of the different rooms, closets, cabinets and drawers are helpful. When video is used, consider commenting as it is shot and be sure to go slow enough and close enough to things becoming recorded.

For your convenience, download a Home Inventory, complete it, and save a copy off premise. Good places for your inventory could be a safety deposit box or digitally, in the cloud if you have server-based storage available like Dropbox

Prepare Your House For Sale

![Tips for Preparing Your House For Sale [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/01/19170457/20170120-Tips-For-Selling-STM-1046x824.jpg)

Real Estate with Joann Samelko

5 Myths About Real Estate Reality TV

When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Reality TV Show Myths vs. Real Life:

Myth #1: Buyers look at 3 homes and make a decision to purchase one of them.

Truth: There may be buyers who fall in love and buy the first home they see, but according to the National Association of Realtors the average homebuyer tours 10 homes as a part of their search.

Myth #2: The houses the buyers are touring are still for sale.

Truth: The reality is being staged for TV. Many of the homes being shown are already sold and are off the market.

Myth #3: The buyers haven’t made a purchase decision yet.

Truth: Since there is no way to show the entire buying process in a 30-minute show, TV producers often choose buyers who are further along in the process and have already chosen a home to buy.

Myth #4: If you list your home for sale, it will ALWAYS sell at the Open House.

Truth: Of course this would be great! Open houses are important to guarantee the most exposure to buyers in your area, but are only a PIECE of the overall marketing of your home. Just realize that many homes are sold during regular listing appointments as well.

Myth #5: Homeowners make a decision about selling their home after a 5-minute conversation.

Truth: Similar to the buyers portrayed on the shows, many of the sellers have already spent hours deliberating the decision to list their homes and move on with their lives/goals.