All posts by Joann Samelko, REALTOR®

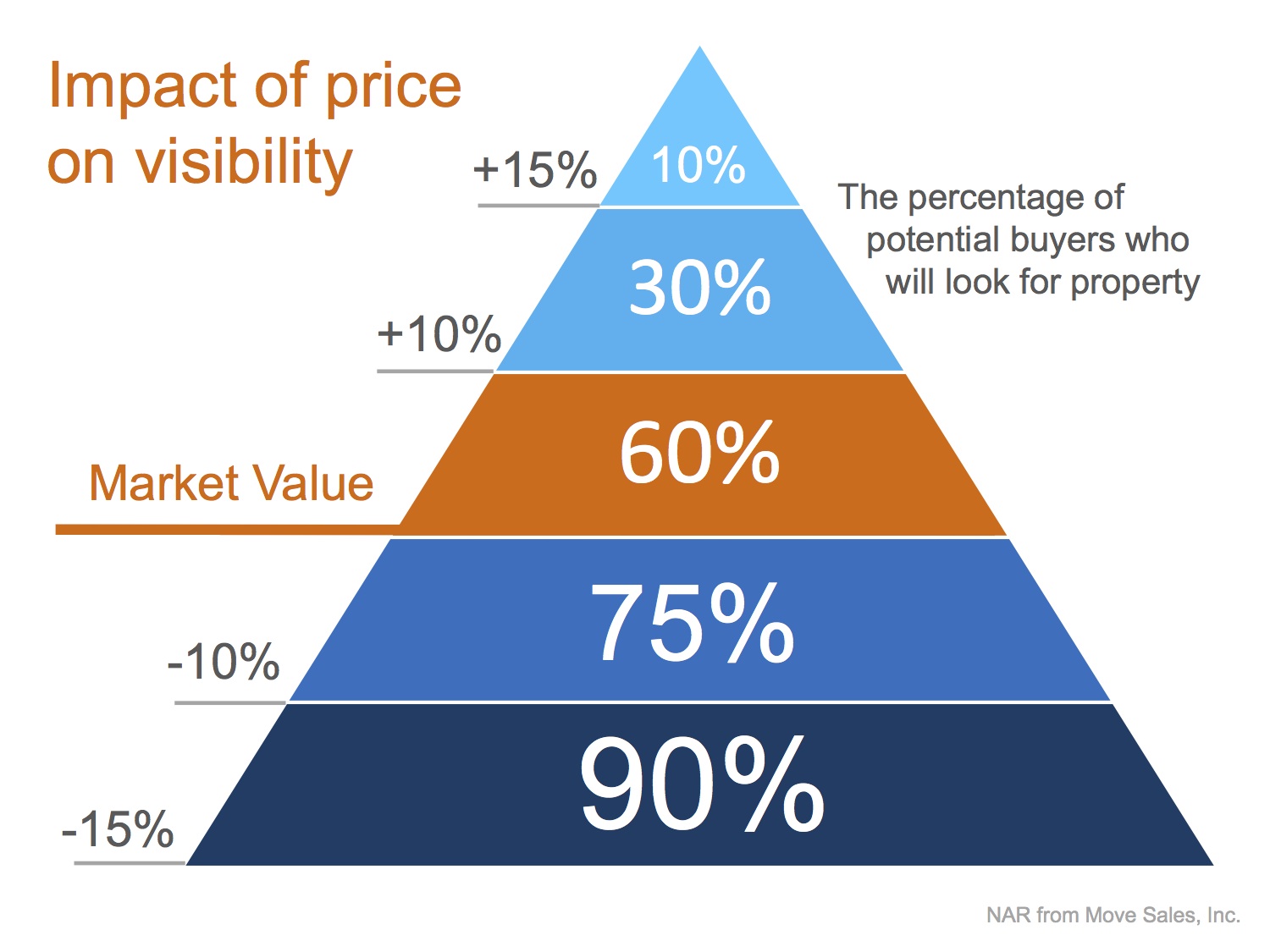

The Impact of Price on Visibility

Selling Your House? Price it Right Up Front

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.

There is no “later.”

Sellers sometimes think, “If the home doesn’t sell for this price, I can always lower it later.” However, research proves that homes that experience a listing price reduction sit on the market longer, ultimately selling for less than similar homes.

John Knight, recipient of the University Distinguished Faculty Award from the Eberhardt School of Business at the University of the Pacific, actually did research on the cost (in both time and money) to a seller who priced high at the beginning and then lowered the their price. In his article, Listing Price, Time on Market and Ultimate Selling Price published in Real Estate Economics revealed:

“Homes that underwent a price revision sold for less, and the greater the revision, the lower the selling price. Also, the longer the home remains on the market, the lower its ultimate selling price.”

Additionally, the “I’ll lower the price later” approach can paint a negative image in buyers’ minds. Each time a price reduction occurs, buyers can naturally think, “Something must be wrong with that house.” Then when a buyer does make an offer, they low-ball the price because they see the seller as “highly motivated.” Pricing it right from the start eliminates these challenges.

Don’t build “negotiation room” into the price.

Many sellers say that they want to price their home high in order to have “negotiation room.” But, what this actually does is lower the number of potential buyers that see the house. And we know that limiting demand like this will negatively impact the sales price of the house.

Not sure about this? Think of it this way: when a buyer is looking for a home online (as they are doing more and more often), they put in their desired price range. If your seller is looking to sell their house for $400,000, but lists it at $425,000 to build in “negotiation room,” any potential buyers that search in the $350k-$400k range won’t even know your listing is available, let alone come see it!

A better strategy would be to price it properly from the beginning and bring in multiple offers. This forces these buyers to compete against each other for the “right” to purchase your house.

Look at it this way: if you only receive one offer, you are set up in an adversarial position against the prospective buyer. If, however, you have multiple offers, you have two or more buyers fighting to please you. Which will result in a better selling situation?

The Price is Right

Great pricing comes down to truly understanding the real estate dynamics in your neighborhood. Look for an agent that will take the time to simply and effectively explain what is happening in the housing market and how it applies to your home. You need an agent that will tell you what you need to know rather than what you want to hear. This will put you in the best possible position.

Baby Boomers: Home Is Where The Heart Is

Within the next five years, Baby Boomers are projected to have the largest household growth of any other generation during that same time period, according to the Joint Center for Housing Studies of Harvard. Let’s take a look at why…

Within the next five years, Baby Boomers are projected to have the largest household growth of any other generation during that same time period, according to the Joint Center for Housing Studies of Harvard. Let’s take a look at why…

In Merrill Lynch’s latest study, “Home in Retirement: More Freedom, New Choices” they surveyed nearly 6,000 adults ages 21 and older about housing.

Crossing the “Freedom Threshold”

Throughout our lives, there are often responsibilities that dictate where we live. Whether being in the best school district for our children, being close to our jobs, or some other factor is preventing a move, the study found that there is a substantial shift that takes place at age 61.

The study refers to this change as “Crossing the Freedom Threshold”. When where you live is no longer determined by responsibilities, but rather a freedom to live wherever you like. (see the chart below)

As one participant in the study stated:

“In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve had that kind of freedom.”

On the Move

According to the study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement.

The top reason to relocate cited was “wanting to be closer to family” at 29%, a close second was “wanting to reduce home expenses”. See the chart below for the top 6 reasons broken down.

Not Every Baby Boomer Downsizes

There is a common misconception that as retirees find themselves with less children at home that they will instantly desire a smaller home to maintain. While that may be the case for half of those surveyed, the study found that three in ten decide to actually upsize to a larger home.

Some choose to buy a home in a desirable destination with extra space for large family vacations, reunions, extended visits, or to allow other family members to move in with them.

“Retirees often find their homes become places for family to come together and reconnect, particularly during holidays or summer vacations.”

Bottom Line

If your housing needs have changed or are about to change, meet with a local real estate professional in your area who can help with deciding your next step.

FHA or Conventional?

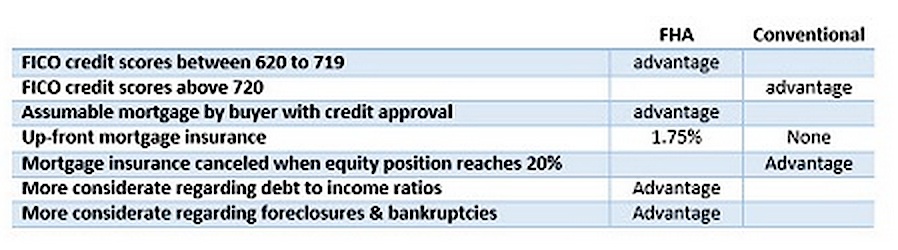

Buyers with a minimum down payment are generally faced with the decision of whether to get a FHA or a conventional loan.  With the new 3% down payment program on conventional loans, it may become more confusing which loan to pursue.

With the new 3% down payment program on conventional loans, it may become more confusing which loan to pursue.

The two loan programs have mortgage fees that can differ greatly. FHA has a 1.75% up-front mortgage insurance charge in addition to the monthly mortgage insurance charge which was recently lowered by .5%.

FHA’s mortgage insurance is a fixed amount where conventional mortgage insurance providers’ fees are determined by individual companies and according to the credit score of the borrowers. A borrower with a good credit score will be charged less than a borrower with a marginal credit score.

Mortgage insurance on conventional loans can be cancelled when the equity in the property reaches 20%. FHA mortgage insurance in most cases, is paid for the life of the mortgage. Once a borrower has a 20% equity in their home, to eliminate the monthly FHA mortgage insurance, they would need to refinance the home with a conventional loan and would not be eligible for any refund of the up-front fee paid at closing or added to the mortgage.

If a borrower has a low credit score, FHA may be the better choice because conventional underwriters may have a higher minimum score.

FHA loans also tend to be more lenient than conventional loans when a borrower’s total monthly debt exceeds 45% of their monthly income. FHA tends to allow borrowers a shorter time frame after foreclosures and bankruptcies.

The decision-making factor is which mortgage will provide the lowest cost of housing including payment and all loan fees. A lot of information is necessary to make a good decision and typically, the borrower isn’t able to acquire it on his/her own.

A trusted mortgage professional is very valuable in not only providing the information but guiding the borrower through the entire process. Your real estate professional is uniquely qualified to make such a recommendation.

Open House March 21st & March 22nd

http://search.joannsamelko.com/1-1984353/1161-Golden-Star-Way-Wake-Forest

http://search.joannsamelko.com/1-1984353/1161-Golden-Star-Way-Wake-Forest

2 to 4pm: Open House: Heritage Wake Forest

1161 Golden Star Way, Wake Forest NC

$379,900 Over 3000 Square Feet, 4 Bedrooms,

Multigenerational Living Space with 2 Master Suites

Upgraded, Hardwoods, Granite, Stainless

Happy St. Patrick’s Day!

Selling a Property with a Tenant

Trying to Sell Your Home With a Tenant in Place May Bring Back Visions of the movie “Pacific Heights”

If you rented out your home to a tenant instead of selling the house you might be ready now to put it on the market. The effort to sell a home can be complicated by the presence of a renter.

If you rented out your home to a tenant instead of selling the house you might be ready now to put it on the market. The effort to sell a home can be complicated by the presence of a renter.

Many real estate agents recommend waiting until your lease expires and selling your home without a renter in residence, not all landlords can afford to have their home vacant during the transition.

There are some great tenants that are cooperative. But in general, having a tenant can have a negative impact on a home that’s on the market. Normally, the home drops in value because of the condition of the home and the lack of access for agents and prospective buyers.”

Many real estate agents are reluctant to show buyers a tenant-occupied home because they expect resistance to allowing visitors into the property and assume the condition will be less than optimal. Smart tenants can hold up a sale for as long as year if they don’t want to move.

Tenant cooperation

For those homeowners who do choose to sell with a tenant in residence, landlords need to try to get the tenant to cooperate.

It’s one thing if the tenant already wants to move, but a tenant who doesn’t want to move can be down right hostile.

It is a difficult situation when a tenant denies access to Realtors and prospective purchasers. Some renters deny access to protect privacy, to hide who really lives in the unit, or to kill deals.

Are You Really Losing Money Leaving The House Unrented During The Sale?

With a tenant in place you basically reduce the pool of potential buyers significantly. A reduction in potential buyers also reduces the potential for a higher sales price. The amount of rent you’ll receive while the house is on the market could be much less than the overall drop in the sales price. At the end of the day, you’ll either breakeven in rent-vs-price drop or lose money depending on the market, condition of the house and cooperation of the tenant.

In the end, if the tenant is on a month to month lease, you should consider giving the tenant notice to move so that you can sell your home for the most money in the shortest period of time.

Invisible, Odor-free and Potentially Hazardous

Most people’s first introduction to Radon is during the inspections of a home. It can be as much a surprise to a seller as it is a buyer. Radon is an invisible and odor-free, cancer-causing radioactive gas.

Most people’s first introduction to Radon is during the inspections of a home. It can be as much a surprise to a seller as it is a buyer. Radon is an invisible and odor-free, cancer-causing radioactive gas.

Radon can get into a home through cracks in solid floors, construction joints, cracks in walls, gaps in suspended floors, gaps around service pipes, cavities inside walls and even the water supply.

It is estimated that one out of every fifteen homes in the United States has elevated radon levels. The EPA recommends that you test your home which is the only way to find out if you and your family are at risk. If the level found is 4 picocuries per liter or higher, the EPA suggests that you make repairs or install a radon reduction system. Even lower levels can have health risks.

The EPA’s interactive map is available to find state and county information but still recommends that all homes should test for radon. More information can be found from the EPA in A Citizen’s Guide to Radon.

Test kits are inexpensive and can be purchased at stores like Lowe’s or Home Depot if you choose to do it yourself. If levels indicate a high enough level, you can contact a qualified radon service professional for another test or to mitigate your home. You can get information on identifying these professionals at www.nrpp.info and www.nrsb.org.

Let Your Tenants Send Your Kids to College

Most people have lots of reasons to save but not always enough discretionary income after the family essentials have been met.

A relatively small investment in a rental home can control a good home that will rent easily, generate positive cash flows and pay for itself. The borrowed funds create leverage that earns a return on the total value of the home and not just the amount of cash you have invested.

The strategy is simple. Find a slightly below average priced home that will rent well. It will appeal to a larger group of people while it’s rented and when it’s ready to be sold.

Rent the home and maintain its condition over the years. As the loan amortizes and the value increases, the equity will grow. When your student is ready to start college, you’ll actually have several options.

You can sell the property; pay the tax on the gain at the reduced capital gains rate and fund the education. Another option would be to refinance and take the proceeds to pay for the tuition. This would allow you to continue to own the asset but would free your equity and under current tax laws is a non-taxable event.

Regardless of whether you’re trying to plan for your children’s education or your own retirement, rental property offers many solid investment opportunities. All investments contain risk. Knowledge and expert advice from tax professionals can reduce the risk. Contact me if you want more information.