Buyers with a minimum down payment are generally faced with the decision of whether to get a FHA or a conventional loan.  With the new 3% down payment program on conventional loans, it may become more confusing which loan to pursue.

With the new 3% down payment program on conventional loans, it may become more confusing which loan to pursue.

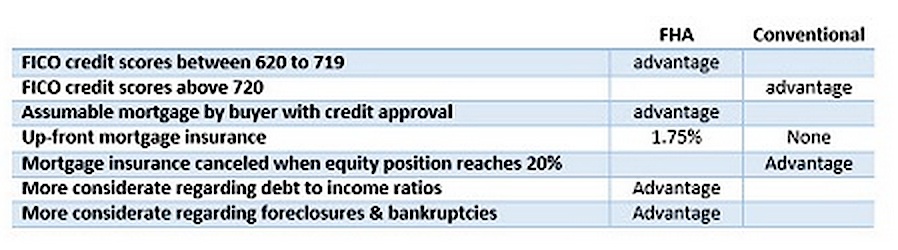

The two loan programs have mortgage fees that can differ greatly. FHA has a 1.75% up-front mortgage insurance charge in addition to the monthly mortgage insurance charge which was recently lowered by .5%.

FHA’s mortgage insurance is a fixed amount where conventional mortgage insurance providers’ fees are determined by individual companies and according to the credit score of the borrowers. A borrower with a good credit score will be charged less than a borrower with a marginal credit score.

Mortgage insurance on conventional loans can be cancelled when the equity in the property reaches 20%. FHA mortgage insurance in most cases, is paid for the life of the mortgage. Once a borrower has a 20% equity in their home, to eliminate the monthly FHA mortgage insurance, they would need to refinance the home with a conventional loan and would not be eligible for any refund of the up-front fee paid at closing or added to the mortgage.

If a borrower has a low credit score, FHA may be the better choice because conventional underwriters may have a higher minimum score.

FHA loans also tend to be more lenient than conventional loans when a borrower’s total monthly debt exceeds 45% of their monthly income. FHA tends to allow borrowers a shorter time frame after foreclosures and bankruptcies.

The decision-making factor is which mortgage will provide the lowest cost of housing including payment and all loan fees. A lot of information is necessary to make a good decision and typically, the borrower isn’t able to acquire it on his/her own.

A trusted mortgage professional is very valuable in not only providing the information but guiding the borrower through the entire process. Your real estate professional is uniquely qualified to make such a recommendation.